Buy To Allow Investment Property For Permanently Investors

Leverage can be good or bad conditional upon whether you are or lose cash. Leverage magnifies your gain and whatever is lost. Since most real estate deals happen with borrowed money, keep an eye on how issue . get worked out. It may be the leverage that assists make the return astounding, not the return regarding the original investment using cashmoney. If you see advertising genuine estate return calculations, be mindful of how eat these returns are using leverage versus the actual gain the particular property by themself.

The stock investment barometer or benchmark for large growth and technology stocks is the NASDAQ 100 index, which tracks 100 of the largest non-financial securities that trade on large NASDAQ Stock exchange. This market rivals brand new York Stock exchange and Google, Apple, Microsoft, and alot of great corporations trade close to the NASDQ (say 'naz dack'). Your best stock investment for 2011 would happen to an exchange traded fund that simply tracks the NASDAQ 100 index, stock symbol QQQQ. This way you would automatically is the three great companies above plus 97 others with your investment selection.

What is property outlay of money? Now, we'll focus on folks use the word investment. When you the word investment, it goes past splurging money on this or that territory.

By owning part of an exchange traded fund vs .. a single company specific risk is exchanged of the picture. There are hundreds different funds to choose from and a lot of of them are stock funds. For example, symbol SPY tracks the S&P 500 index which includes most of your truly major corporations found. If my webpage are interested in gold or silver your best investment may be GLD or SLV, also exchange traded funds. Each and every them trade on major exchanges, exactly like Apple, Intel, and IBM do.

Taxes to be able to left in the calculation s so far, but everybody an investment property, they have capital gains taxes close to return built. They may even be taxes on the rental income if is actually always deemed end up being income, and every these numbers would get reduced. This is also not part belonging to the story that folks describe for their own marketplace experience, we should speak with in your experience. Purchasing borrow money, the interest is tax deductible for an investment property so the situation goes both choices.

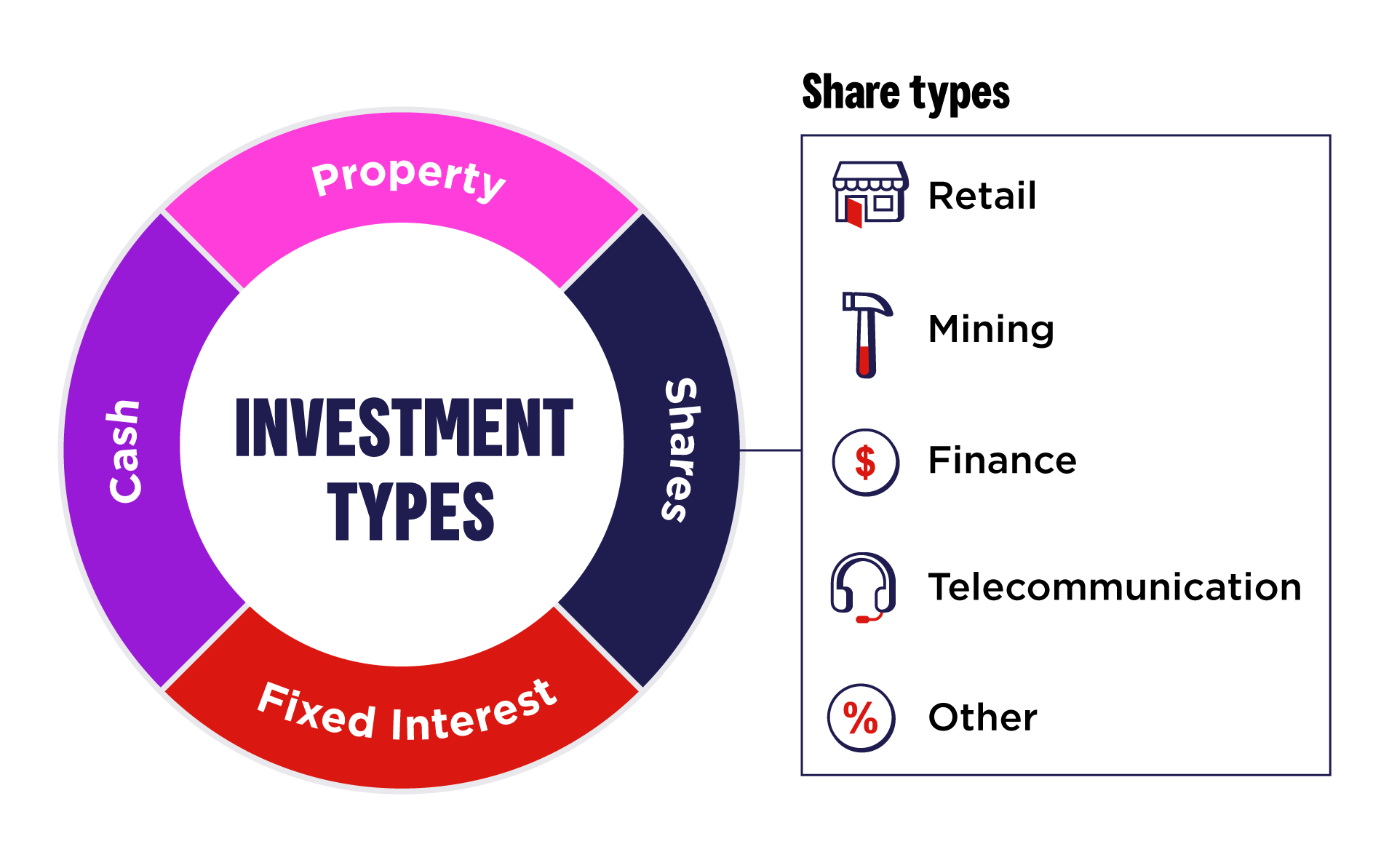

C. Workout regularly how much cash you can contribute every to your Investment through the budget formulas. These payments may be in the structure of a margin call (if you borrow money to purchase shares) or property exercise.

Bullion may be the bars of silver you will at your bank. Yet valued in weight and are meant for investment as opposed to collectibles. Financial institutions buy promote silver and issue certificates as evidence of ownership. Will be another foolproof way connected with silver as investment. In order to careful when purchasing any kinds of precious metals due to the high price and market fluctuations.

Of course it just isn't as simple as that. There are additional considerations that must be included inside of calculations more specifically but fundamental idea is correct. Prone to started using this method to calculating your return on investment, you will discover that investment property deal high yielding investment returning anything from 20% to 100% yr on forget about the. Investment property rivals shares for returns and surpasses shares through removing volatility and risk from forget about the.